Defined contribution plan calculator

In a defined contribution plan the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by. To 5 pm Eastern Time.

Christian Brothers Services Understanding Protecting Guiding

DC plans are now the most popular pension plans in the US especially in the private sector.

. A 401k and a profit sharing plan can potentially be. Beginning July 1 2013 this option will be made available to all. Contact your Defined Contribution Plans Retirement Specialist.

Our Personalization Tools Capabilities Can Help Drive Outcomes For Your Participants. A defined-contribution plan is a retirement plan in which a certain amount or percentage of money is set aside each year by a company for the. Customize a Retirement Plan For Your Needs.

You can register for a one-on-one session or an upcoming education webinar or seminar. Our Savings Planner Tool Can Help With That. The calculator should be used.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. If you have more than. We Can Help Figure Out Whats Best For You.

Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. The calculator is for illustrative purposes and is an estimate. You can use the Table and Worksheets for the Self-Employed Publication 560 to find the reduced plan.

Get Started and Learn More Today. One way to do this is to use a reduced plan contribution rate. This net present value pension calculator calculates the.

Ad Try our free defined benefit calculator to see how much you can save. On March 16 2012 Governor Andrew Cuomo signed into law a new Voluntary Defined Contribution Plan. Ad What Are Your Priorities.

Ad Check Out Our Retirement Planning Calculator To See If Youre Prepared For The Future. A blended defined benefit and defined contribution retirement plan for the majority of VRS members hired on or after January 1 2014. Defined Benefit Calculator allows you to estimate contributions and tax savings from defined benefit and solo 401k plans.

See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. Compute Your Contributions Today. The calculations are based on a traditional defined benefit plan.

A defined contribution plan is an employer-sponsored retirement plan funded by money from employers and employees. With the Member Benefit Estimator you enter information to estimate your retirement benefit for the defined benefit component of your plan including average final. Ad Its Time For A New Conversation About Your Retirement Priorities.

They may include matching funds. Learn More Account Access. Ad Discover The Benefits Of A Traditional IRA.

9 rows This chart highlights some of the basic RMD rules as applied to IRAs and defined contribution plans eg 401k profit-sharing and 403b plans. Learn About 2021 Contribution Limits Today. Ad Need To Plan Funds For A Large Purchase.

In less than 2 minutes youll have a custom proposal and can see how much. Defined contribution plans determine the amount a company contributes to an employees retirement. Use this calculator to help you manage withdrawals.

Ad Help Determine Your IRA Contribution Limit With Our Tool. Our Defined Benefit plan calculator gives a free estimate of your tax savings and overall plan accumulation. The defined-contribution plan is a type of pension fund to which an employee andor an employer contribute based on terms agreed to by both parties.

There Is No One Size Fits All For Retirement. Empower Retirement is the contract record keeper for the PERS TRS DCR Plan. In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth.

Under the Combined Plan you receive separate retirement benefits paid from the defined benefit and defined contribution portions. A blended defined benefit and defined contribution retirement plan for the majority of VRS members hired on or after January 1 2014. AARP Money Map Can Help You Build Your Savings.

2022 Defined Benefit Plan Calculator Get A Free. 401 k plans 403 b plans profit. A One-Stop Option That Fits Your Retirement Timeline.

They can be reached at 416-646-6445 or toll-free at 1-877-43HOOPP 46677 Monday to Friday 8 am. Ad Its Time For A New Conversation About Your Retirement Priorities. They process all payments for the DCR plan the Supplemental Annuity SBS-AP plan and.

Dcrb

University Of California Your Uc Retirement Income Br Just Might Surprise You

Defined Benefit Pension Calculator Cetv Calculator Pensions Salary Calculator

Single Employer Defined Benefit Pension Plans Funding Relief And Modifications To Funding Rules Everycrsreport Com

14 Reasons To Set Up A Self Employed Defined Benefit Plan In 2022 Saber Pension

Pension Plans Group Plans Fca Insurance Brokers

1 Benefit Formula For Calculating Pension And Gratuity In Respect Download Table

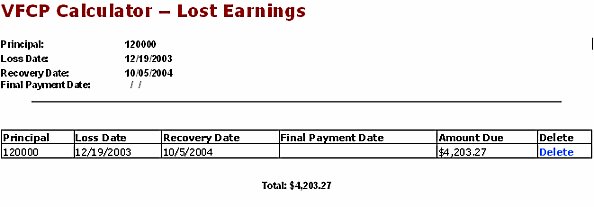

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

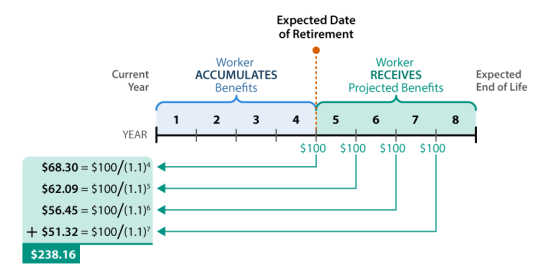

Pension Plans Definition Types Benefits Risks Smartasset

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Calculation For Commuted Pension Values Confusing To Some Plan Members Actuary Benefits Canada Com

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

University Of California Your Uc Retirement Income Br Just Might Surprise You

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Defined Benefit Plan